Knowledge helps people make better investment decisions. You should be having conversations with your tax attorney or accountant any time there is a question about how a real estate investment will affect you and your financial well-being. One of the times this becomes most important is when you are preparing to sell a property, this is the time when knowing the tax implications early can make a huge difference in your net proceeds. Commercial real estate brokers and CCIM’s are here to help you with these conversations. There are opportunities to defer or even reduce the capital gains on a property but if you don’t know what to ask you may miss out. When it becomes time to sell there are some new tax laws that can change the conversation you have with your professionals. Real Estate as an investment has favorable tax treatment and the new tax law adds to the benefits of using real estate to create and maintain wealth.

This is a small portion of a very interesting article explaining opportunity zones versus 1031 tax-deferred exchanges. If you have any questions or think this may be a way that helps you enhance your financial position, please contact us.

Blog by Michael Mark, Commercial Real Estate Broker, CCIM

- Office Charter One Realty Beaufort

- Office Location 1001 Bay Street, Suite 25, Beaufort, South Carolina, 29902

- Office # 843-379-4460

- Cell # 843-812-6023

- Email MMark@CCIM.net

Weighing the Options by Daniel Pessar

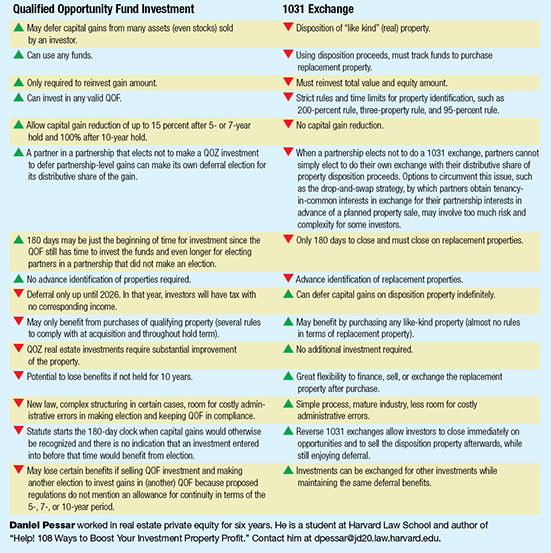

Should long-term real estate investors consider qualified opportunity zone investments for gains deferral instead of more traditional 1031 exchanges?

IRC Section 1031 and the newly enacted Section 1400Z-2 both allow for deferral of capital gains, but they are very different in their benefits and costs. The best approach for investors depends on factors such as their liquidity, the types of real estate they want to own, and their broader portfolio goals. Depending on an investor’s goals and profile, just one benefit or cost may lead it to choose a certain approach.

Leave A Comment