By Charles Sampson, Partner

Charter One Realty

It’s that time of year again! Beaufort County Property Tax Time.

As Ben Franklin once said “Nothing can be said to be certain, except death and taxes.” If you ask me, living here in Beaufort County with Franklin’s two options, I will gladly pay my property taxes. The property taxes on an owner occupied residence are very reasonable at about a rate of ½ of a percent or the home’s value. Property taxes on other types of property are closer to the national norm of about 1.25% of the value.

With the 2015 tax bills in the mail, I checked on 10 of my clients and found some interesting errors. Of the 10, six were correct, two had the wrong mailing address and two I was able to point out approximately a $3,000 savings to each of those clients/friends. It is understandable that one of the clients who had a $3,900 error to their favor, when corrected, visited the county tax office the day the error was brought to his attention. I am happy to say the county is in the process of correcting their error.

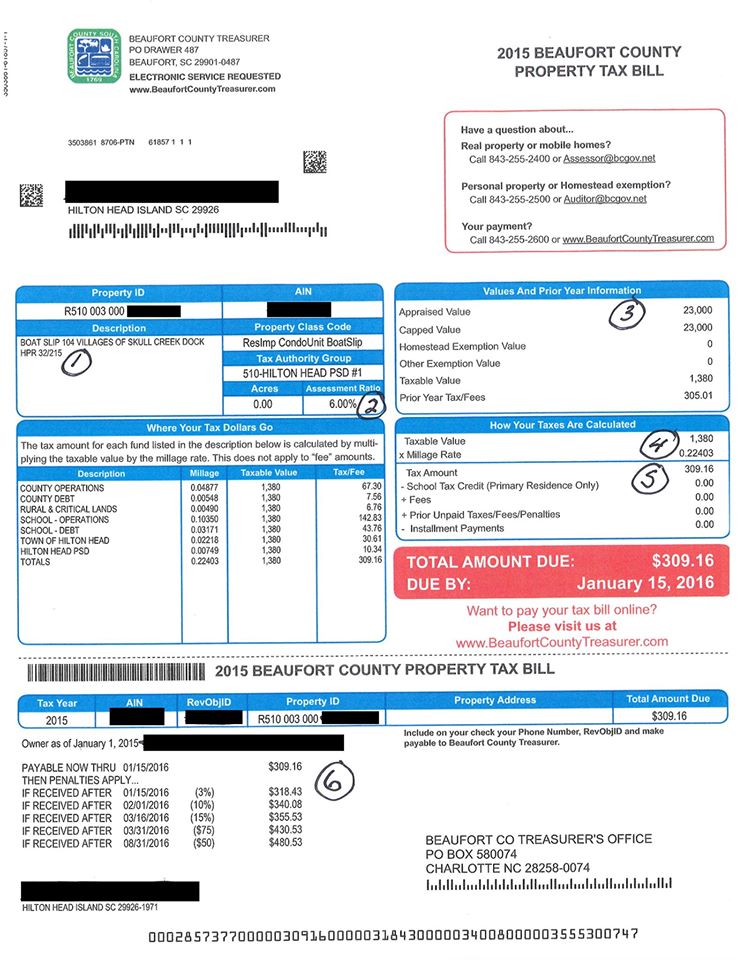

Attached is a Beaufort County 2015 property tax statement.

A very important thing to remember about your 2015 property tax bill is that in Beaufort County, the payment is past due if not paid on or before January 15, 2016. It is no matter if you did not receive your bill – it is still your fault if it is not paid.

The statement below has six items noted that are very important and should be reviewed:

- Description/address of the property. The number above the description is the county tax map info.

- Very Important for your home, villa or vacant lot. This is the assessment ratio. This should be either 4% or 6%. If the property is your owner occupied residence, then the ratio should be 4%. If the property is anything other than owner occupied residence, the ratio should be 6%. Just because your property has been billed at the 4% ratio in past years, does not mean the County has not made an error and changed the property ratio to 6%. If you find this error bring it to the County’s attention so they can correct it.

- Appraised Value is the amount the County feels is the value of your property. If you feel this number is wrong, to high, give us at Charter One Realty.

- We will be glad to help you with information so you can make a protest.

- Appraised value X the assessment ratio. This number is times the millage rate to get the taxes. Different locations within the county have different millage rates.

- The amount of tax you own if paid prior to January 15, 2016

- This shows the penalties for late payments

I hope this short explanation of your Beaufort County 2015 tax billing is helpful. Should you have any questions about the taxes, please feel free to give us a call at Charter One Realty at 844-526-0002. We would be glad to help you with any of your Hilton Head Island or Lowcountry real estate - either buying or selling or just answering real estate questions. To view what is on today’s market, just click www.CharterOneRealty.com. If you are not already a Hilton Head Island or Lowcountry property owner we would love to have you join us as a Beaufort County Property Tax Payer!

Posted by Charter One Realty on

Leave A Comment