As a seller on Hilton Head Island or in Bluffton, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. If you plan on purchasing real estate in the Lowcountry, you must not be concerned only about short term price but also about the ‘long term cost’ of the home.

Put Simply.

When it comes to the ‘cost’ of a home, there are several factors that come into play. A home’s appreciation over time and the interest rate at which a buyer can borrow funds to purchase property are two of the most important factors for today’s buyers. “The Cost of Waiting” is the combination of these two factors and the effect they have on a buyer on the fence about purchasing now or waiting.

The rate at which these two factors can change is often referred to as “The Cost of Waiting”.

12 Month Forecast.

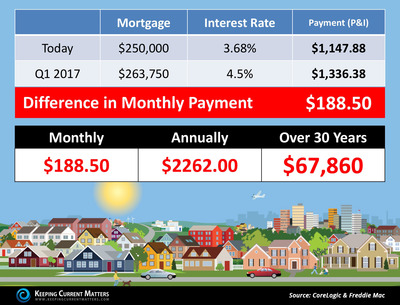

According to CoreLogic’s latest Home Price Index, prices are expected to rise by 5.5% by this time next year.

Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30-year fixed mortgage rate will appreciate to 4.5% in that same time.

What Effect Does This Have On Buyers?

Let’s take a look at the projected impact if as a buyer, you choose to wait. The infographic below from Keeping Current Matters reflects the changes on a mortgage payment of a home selling for approximately $250,000 today versus this time next year.

As you can see, if the interest rate increases as projected and the price of homes increase as projected, the difference in the monthly payment is $188.50. While this number sounds minimal, look at the annual increase and the increase over 30 years.

Leave A Comment