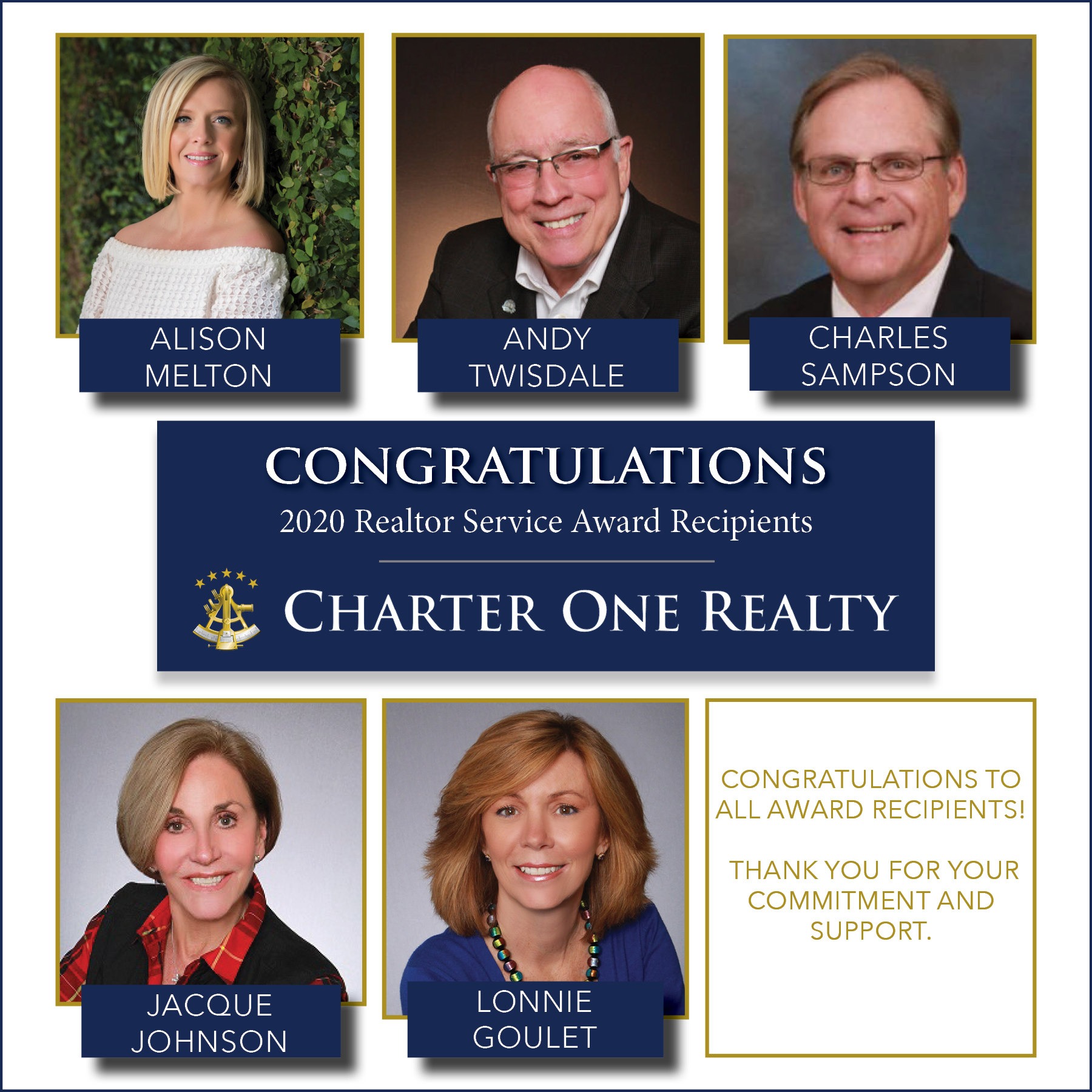

2020 Realtor Service Awards

Posted by Charter One Realty on

Congratulations to the 2020 Realtor Service Award Recipients

Each year, the Hilton Head Area Association of Realtors recognizes Realtors® who have done exceptional work to advance their association, education, and community. These members epitomize what it means to be a Realtor®.

Only a small percentage of the Realtor Association is honored with this distinction. The award recognizes those professionals who are passionate about the real estate industry and their community while adhering to the Realtor® Code of Ethics. These individuals have achieved higher levels of education, served in leadership positions within the association, and volunteered for several organizations in the community.

The following Charter One Realty sales professionals…

365 Views, 0 Comments